Cancer. It’s a word we hear all too much these days. Everyone has a friend or a family member who has been touched by this dreadful disease. Although most of us can empathize with the emotional impact that this disease can have on a family, most people who haven’t lived through it first hand, don’t realize just how expensive this consuming disease can be.

My fiance has cancer. He is 37 years old. He was first diagnosed with cancer before we met. When we met we thought he was cancer free. A year into our relationship, it came back. In his lungs. Stage 4.

The good thing about having cancer in Canada is that most of the ‘traditional’ treatments are covered by MSP (chemo, radiation, surgery). What is not covered is what can really impact your family…hard.

First of all, if you don’t have any disability insurance, you can kiss your income goodbye. And if you did by chance have some disability insurance through work, it will usually only cover about 60% of your income. Imagine having to live on 60% of your income. Your mortgage didn’t get reduced, your rent didn’t go down, your expenses actually go up due to the cancer, but your income is now almost cut in half!

Second of all, having cancer adds a number of expenses that most people don’t think about. Parking at Surrey Memorial Hospital is almost $5 an hour. A typical visit is for two hours, that’s $10, and some people have to go for treatment for months. That can add up alright! Let’s say you have two months of treatment, that’s 40 days, so your so called “MSP covered” treatment has now cost you $400.

Then there is the not so traditional treatment, of eating fresh organic fruits and vegetables, taking supplements, getting counselling, seeing a naturopathic doctor, doing yoga to relax, other prescriptions. These costs all add up!

These days, people are living with cancer longer. And as if having a terminal illness wasn’t enough, you still have to pay your bills and try to live life!

What most clients say to me is, well I am not going to get sick! I don’t need any critical illness insurance, because I will never use it.

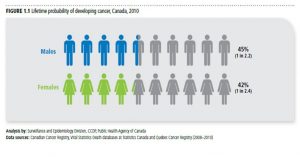

To this I reply, just look at the statistics. 1 out of every 2.2 men and 1 out of every 2.4 women, will be diagnosed with cancer at some point in their life.

At a measly $20 – $50 a month, critical illness insurance can give you some peace of mind, knowing that if you are diagnosed with one of 31 major illnesses, you will receive a tax free lump sum benefits to not have to worry about your finances for a period of time, take time off work, get the treatment you want or take the vacation of a lifetime and live with a little less stress.

And for those of you who think you may not ever make a claim, you can even get critical illness coverage that will give you back a portion of your premium contributions if you never make a claim. Getting a policy on a child is even better, it can be used as a savings vehicle, where all of the premiums paid into it can be refunded to you (or your child) if no claim was ever made.

The Canadian government has started a 5 year action plan to address the issue of financial hardship of cancer in Canada. They have even made this pretty 50 page document outlining the issues that cancer patients face financially. I have yet to see any of these issues addressed by the current government. It is becoming more and more apparent that the government is not going to take care of us, and that the onus has to be on us to ensure we have private medical insurance. If you are self-employed, then this is even more important, and I hope you have made sure to get both disability and critical illness insurance to protect you.

I know from personal experience, that cancer is a nasty disease, both physically, emotionally, and financially. My fiance has to live in the unknown. If he would have had someone offer him critical illness insurance before he got sick, he would have probably not taken it. But if he could go back into time, he would have purchased as much critical illness insurance as possible. Receiving a tax free lump sum benefit would have allowed him to pursue any treatment he wished, and it would have eased his financial burden.

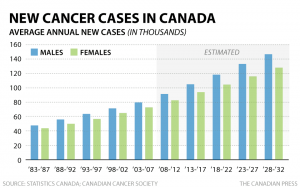

And one thing is for certain, cancer is not going away. Every year, cancer rates are increasing. We all know a loved one who has had cancer. Just look at the statistics below.

And last but not least, the financial impact of having a loved one take time away from work to care for you if you are diagnosed with cancer. Depending on your care-takers employer, this can be an issue. Time away from work usually means time unpaid. And if your care taker is self-employed, every day they take off usually means the loss of an entire days pay.

Let’s face it, cancer is an expensive disease to have. When diagnosed with cancer, a patient has so many unknowns in their future. How long will I live? Who will take care of me? Will I ever go back to work? Critical illness insurance can allow your family to have piece of mind, knowing that if you are one day diagnosed, there is some financial assistance in place that can help ease the burden.

Have more questions? Send an email to anita@babysavings.ca to get a free personalized consultation on assessing your needs.

Add Comment